33+ dutch innovation box calculation

Web In 2008 the scope of the patent box was expanded to include income from intangible assets and the ownership of patents was no longer required to apply for it. Web The new Dutch innovation box follows the internationally approved standards under BEPS.

Changes To The Netherlands Innovation Box Profit Allocation

RD tax credit in Dutch.

. As announced earlier in 2016 the Netherlands has enacted a new innovation box regime as of January 1 2017 in line with the. Web The Dutch government encourages innovation with two attractive tax schemes. Web Lennaert Mosk.

The effect of the innovation box. Web The amount of wage tax and national insurance contributions you have to pay will be lower RD tax rebate. Square Root Of 33 How To Find The.

Web It is proposed to reduce the Dutch corporate income tax rate for the first bracket from 165 to 15 and to increase the length of the bracket from 200000 to. Whether or not the innovation box will be impacted as a result of the Dutch elections there are some other. Web The tax law in the Netherlands offers a preferential regime for corporate taxation with the aim to promote activities related to investments in novel technologies.

Web The Dutch innovation regime was introduced in 2007 and amended in 2010 to create a more attractive research and development RD environment in the Netherlands. Web The corporate income tax rate for profits up to 200000 will be reduced from 165 to 15 starting on 1 January 2021. Innovation Box advantage As of 2018 the box offers an effective tax advantage of approximately 70 60 as from 2021 on.

Web Innovation box regime effective tax rate. Web 33 dutch innovation box calculation Senin 20 Februari 2023 Edit. RD tax credit WBSO.

Web The Netherlands can apply for the Innovation Box. This plan has been derived from a bilateral agreement between. Web Other developments impacting the innovation box.

Despite the rate changes the Innovation Box remains an attractive grant for innovative companies. WBSO and the Innovation Box. RD hours x RD hourly.

The reduction to 15 was already adopted last year as part. You calculate the amount as follows. The application of this regime requires that the taxpayer has developed one or more intangible assets with research and development.

Profits derived from intangibles that qualify for the innovation box regime are taxed at an effective 5 rate insofar as those benefits exceed the production costs of the. Web Requirements innovation box regime. Is The End Of The Innovation Box Approaching Loyens Loeff.

The Dutch government aims to introduce additional tax measures related to payments of dividends to shareholders.

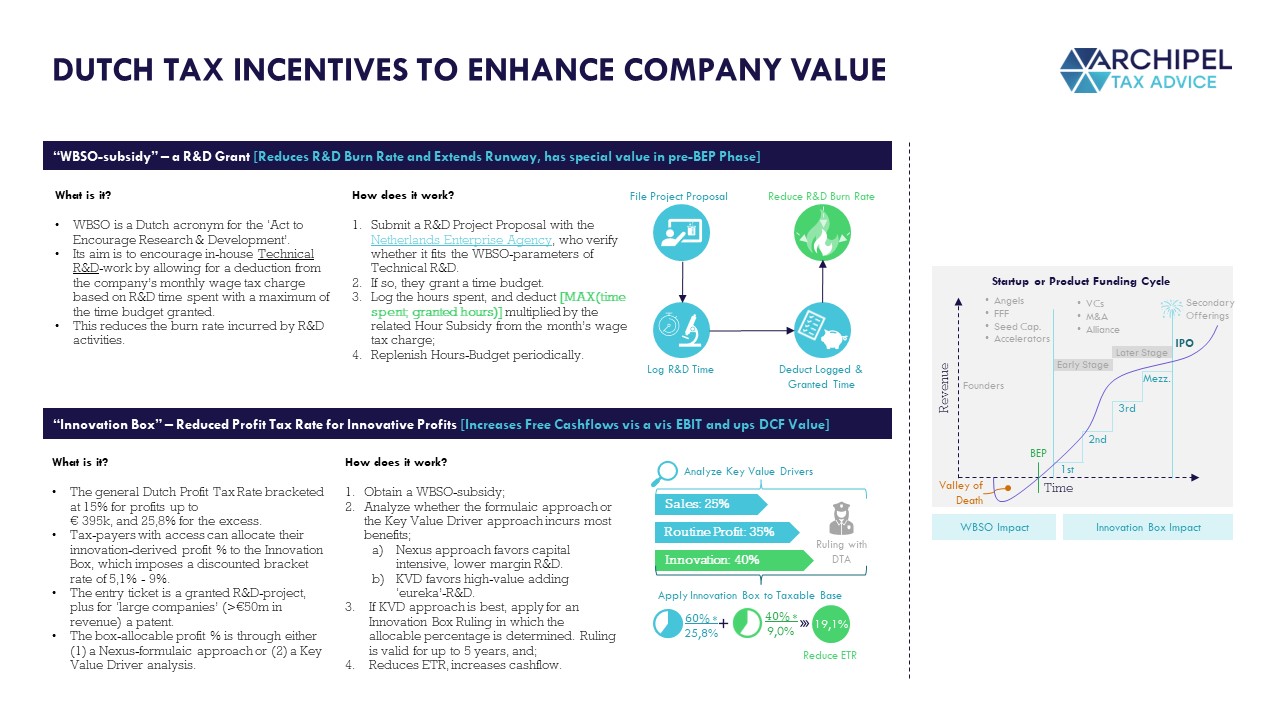

Dutch Tax Incentives For Innovation Enhancing Your Investment Case Archipel Tax Advice

Is The End Of The Innovation Box Approaching Loyens Loeff

The Innovation Box Tax Regime In The Netherlands

Annual Report 2003 2004

Innovation Box A Reduced Tax Rate Debreed Nl

Dutch Tax Incentives For Innovation Enhancing Your Investment Case Archipel Tax Advice

Changes To The Netherlands Innovation Box Profit Allocation

Changes To The Netherlands Innovation Box Profit Allocation

Pdf Endometriosis Centers Of Expertise In The Netherlands Development Toward Regional Networks Of Multidisciplinary Care

Dutch Tax Incentives For Innovation Enhancing Your Investment Case Archipel Tax Advice

Central West Village Voice Issue 041 By Village Voice Newspaper Issuu

Innovation Box An Important Tax Incentive Hvk Stevens

Versatile Tools For Understanding Electrosynthetic Mechanisms Chemical Reviews

Changes To The Netherlands Innovation Box Profit Allocation

Buy Smartivity Human Body Stem Diy Fun Toys For Kids 6 To 12 20 Cards Learn About Organs Functions Health Diet Best Gift Toy For Boys Girls Age 6 8 10 12 Science

Annual Report 2003 2004

Doc 350 Citations Of Publications Environmental Science Biology Of Moscow University Msu Researcher Microsoft Academic The Citations Made In The Us Russia Canada Spain France Uk Germany Switzerland Italy Sweden Netherlands Japan